Student life is new and exciting. You get to enjoy more independence, live away from your parents, learn new skills, and make new friends. However, with independence comes new responsibilities. And managing your finances is one of them.

There is no denying that managing money as a student is difficult. Between paying bills and buying groceries, to hanging out with friends and paying out for academic books, student life is expensive. And that doesn’t even account for all that student debt…

Overwhelming, right?

We’re here to help. Trust us when we say that it’s not impossible to save money as a student and set yourself up for success. By following our 7 tips, you can set aside savings each month that will help you on your way to buying a car, getting your own place, and improving your credit score (to name a few!) Let’s get started.

1. Learn How to Budget

Many students worry about making ends meet at university. According to Save the Student, “the majority of students feel as though the Maintenance Loan is not big enough”. Most students don’t have enough income to cover all their monthly expenses without having to take on a part-time job.

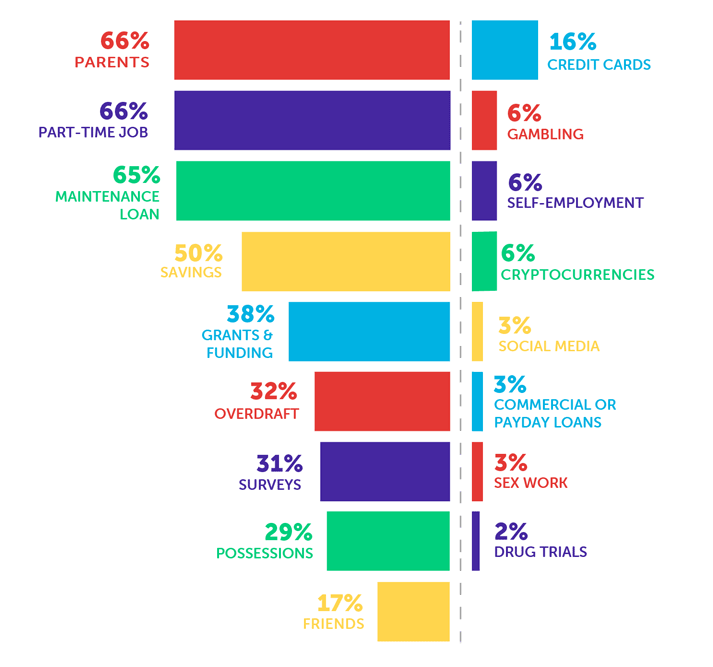

Here we see how students have accessed money in 2020/21, compared to the previous academic year:

This is where budgeting comes in useful. Budgeting helps increase your financial security by breaking down your monthly costs so that you know exactly how much is coming in and going out each month. When you have this information, you can see how much money you are earning, how much you are spending, and how much can be set aside and saved.

Thankfully, we live in a digital world and budgeting is easier than ever before. In fact, there are hundreds of budgeting apps out there that can help you take control of your finances, such as:

- Money Dashboard

- Yolt

- Plum

Getting your finances in line will help you in the long run. Many companies, phone contract providers, employers, and mortgage lenders can run a credit search on you to determine whether you’re high risk. “If you have bad credit of any kind, getting a mortgage can be more difficult and the consequences of approaching the wrong lender or being declined can be more severe,” says Pete Mugleston, Managing Director at Online Mortgage Advisor “[T]he good news is that bad credit doesn’t mean you can’t get a good deal, and help is out there.”

While the thought of organising your finances and creating a budget may seem daunting (and perhaps a little boring) it’s not as difficult as it sounds and once you’re done you will feel more in control of your finances and be able to avoid any bad credit being associated with your file in the future.

2. Buy Everything Secondhand

We understand that when you move away from home, the thought of buying things for yourself and saying goodbye to those hideous hand-me-downs is exciting. But it can get pretty expensive pretty fast!

If you want to save money, buying secondhand is a great alternative to retail prices. You can find just about anything secondhand. From the textbooks on your reading list to clothes and furniture. It is always cheaper to buy secondhand and, just think, you’re helping give items a second chance and keeping them out of landfill which is just another bonus!

3. Make the Most of Student Discounts

One of the many great things about being a student is the sheer number of discounts you receive! Do your research and get to know exactly which high street stores offer student discounts and prioritise these stores when you go shopping. You could literally save hundreds of pounds.

What’s more, for just £14.99 per year you can sign up for a TOTUM Card (formerly NUS Extra). These little cards are powerhouse money savers. Providing access to over 350 discounts online and in store, NUS Extra cards are a must-have and can save you a fortune during your time at university!

4. Take on a Side Hustle

Student life can be expensive, which is exactly why most students hold down part-time jobs while they are studying. Taking on a part-time job is a great way to bring in some extra income and will help increase your monthly saving amount so that you can reach your financial goals faster.

There are many jobs you can take on as a student; from serving in a pub or a restaurant and cleaning properties to shelving books in the library. And if you’re looking for something a little closer to home and that can flex around your demanding schedule, there are plenty of virtual options. For example, you could become a virtual assistant, an online tutor, or even sell your lecture notes online. Taking on a side hustle is a great way to save as a student. For example, you could become a virtual healthcare assistant, an online tutor, or even sell your lecture notes online.

5. Get Rid of Unnecessary Subscriptions

While getting that gym membership at the start of the year may have been a good idea at the time, if you don’t actually go it’s a waste of money. Don’t worry. We’re not judging. We’ve all been there. Cut the cost now and when you’re sure you can commit to regular gym sessions to make it worth your while, you can always re-subscribe.

Cutting out all unnecessary subscriptions is a great way to optimise your budget and ensure you’re only spending money on things you actually use. We recommend going through your bank account and writing down all your monthly subscriptions and then removing the ones you don’t need. Just make sure you keep Netflix...obviously.

6. Shop During Clearance Hours

The reduced section is a God-send for students who are strapped for cash. Most supermarkets reduce numerous unsold products at the end of each day. This is the best time to go in and grab some great deals! You will find any food due to go out of date within a day or two is significantly marked down in price. So, a ready meal that might normally cost you £3.50 may only cost £1.90. It’s a no-brainer.

So, the next time you go shopping, consider leaving it a little bit later in the day so that you can make the most of the reduced section and snatch up some great deals. You will make some pretty incredible savings.

7. Get Creative

It’s fair to say that most of your friends at university also struggle with money and having enough of it. Whether they have a budget or not is another question. However, it’s very likely they would enjoy a cheap night out.

Socialising is often the most expensive part of student life. Everything from going down the pub to catching a film at the cinema costs money. And many students feel the pressure to spend a lot of their cash on social outings so they make friends. But there are cheaper options - all it takes is a little bit of creativity!

Instead of going to the pub or out to dinner, why not pack a picnic and head to the park? Rather than paying a fortune at the cinema, why not binge the latest show on Netflix? Rather than going clubbing on a Friday, why not go camping for the weekend? It is possible to have fun and make memories at university without watching your bank balance rapidly decline. It just takes a bit of creativity and a willingness to think outside the box.

Final Words

So, there you have it. 7 ways to save more as a student. We hope this article has encouraged you that it is possible to save money and still enjoy the university experience. Most importantly, you should make the most of your time and enjoy the experience of meeting new people, learning new things, and becoming more independent. And hopefully our money-saving tips will help you do all this without worrying about money.

Register now with StudentJob

Do you want to be kept up to date on the latest jobs for students? Register for free on StudentJob.

Share this article

Popular posts

Register now with StudentJob

Do you want to be kept up to date on the latest jobs for students? Register for free on StudentJob.

Register